Fifty Years of Housing New Mexico

50 Stories from 50 Years

For five decades, we've been dedicated to transforming lives through housing. As we celebrate our journey, we're sharing 50 powerful stories—told through photos, videos, and personal experiences from those we've helped along the way—as well as highlighting the individuals who have contributed to Housing New Mexico's milestones.

Every week, we’ll unveil two new stories, building up to our Housing Summit in September. Come back often, explore our history, and see firsthand the impact we've made together. You won’t want to miss a single story!

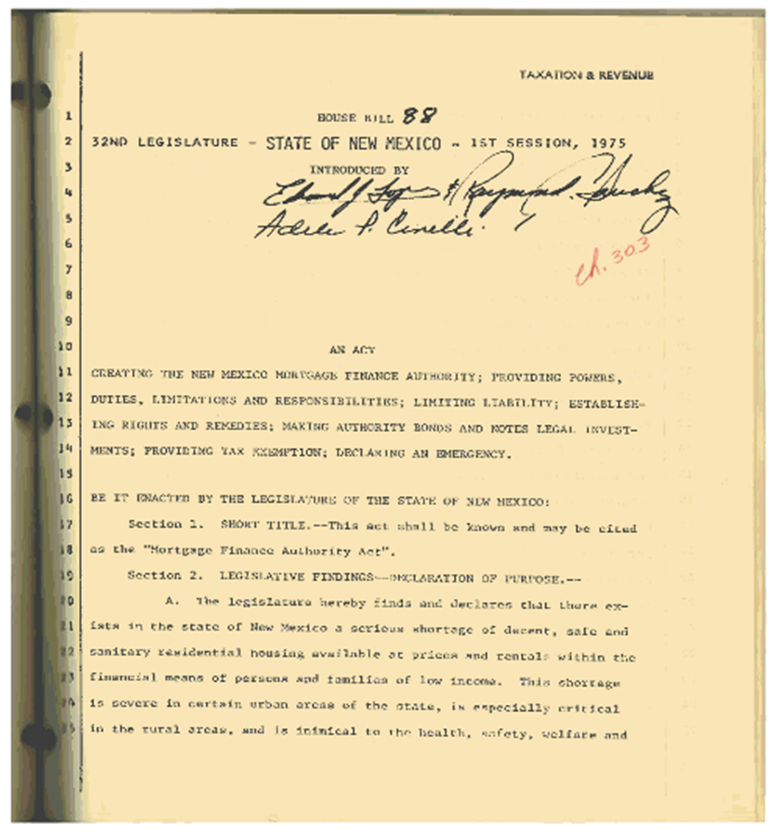

Day 1

As we gear up for the 2025 New Mexico Housing Summit, we’re launching 50 Stories from 50 Years —a journey through the moments that shaped Housing New Mexico. Day 1 of 50: The House Bill that started it all (1975) Rep. Adele Cinelli Hundley recruited legislators who “had the political muscle” to get the proposed housing agency legislation passed. Reps. Cinelli Hundley, Raymond Sanchez and Edward Lopez introduced the Mortgage Finance Authority Act as House Bill 88 during the 1975 State of New Mexico legislative session (32nd legislature).

Day 2

A Housing New Mexico (then known as New Mexico Mortgage Finance Authority) employee and pillar of the community who gave his life to affordable housing, received his first loan in 1976 under the Loans to Lenders program. New Mexico lost a great and unselfish advocate for the poor, rural families and Native American housing with the loss of Schmeider in 2016.

Day 3

First bond ever! In December 1976, Housing New Mexico made history with its first-ever bond issue—a $20 million bond sale! 💰 This milestone helped lay the foundation for expanding affordable housing opportunities across the state. Pictured here in 2015, former Rep. Adele Cinelli Hundley, and lobbyist and chairman of Housing New Mexico’s first board of directors Toby Michael, were instrumental in the success of Housing New Mexico in 1976, when the first bond issue was executed.

Day 4

Our first home: Did you know? After working out of rented space for several years, Housing New Mexico purchased its first office building in 1979 at 115 Second Street in Albuquerque. Payment on the building, known as the Roger Cox building, was only $621 per month! Even the furniture and equipment had a unique story—they were purchased from the Gallup Urban Development Agency.

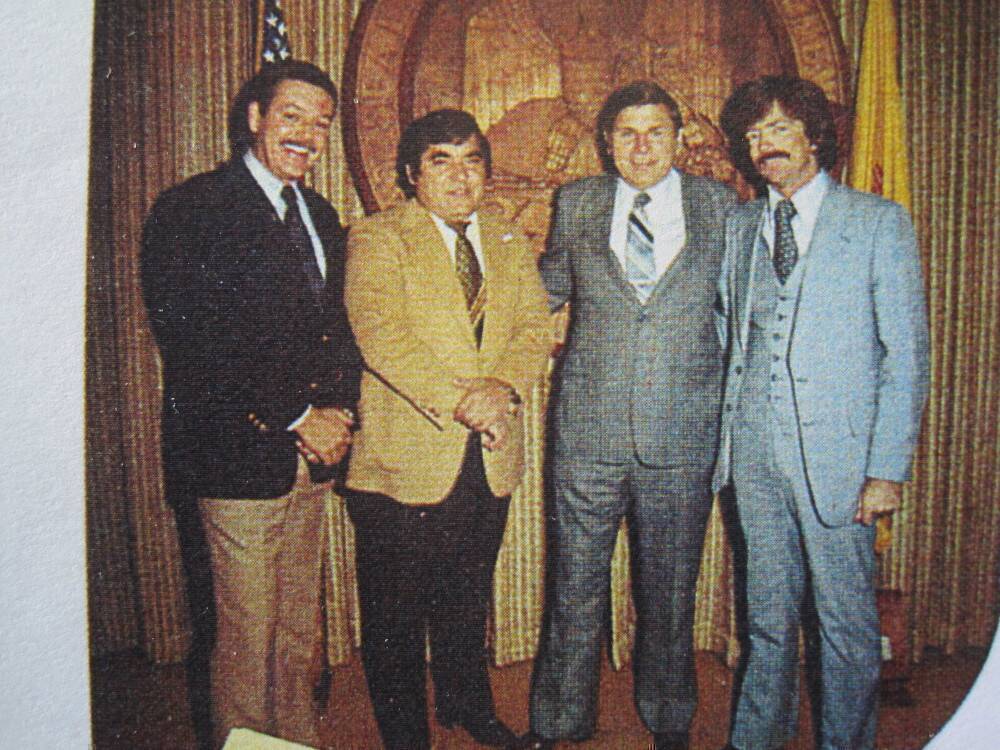

Day 5

Beginnings: Reflecting on the early days of Housing New Mexico (1979-1983). From left to right: Tom Hundley, first executive director; Toby Michael, chairman of the board; former Gov. Bruce King; and Larry Griffis, first deputy director. We are proud of our beginnings and the journey ahead!

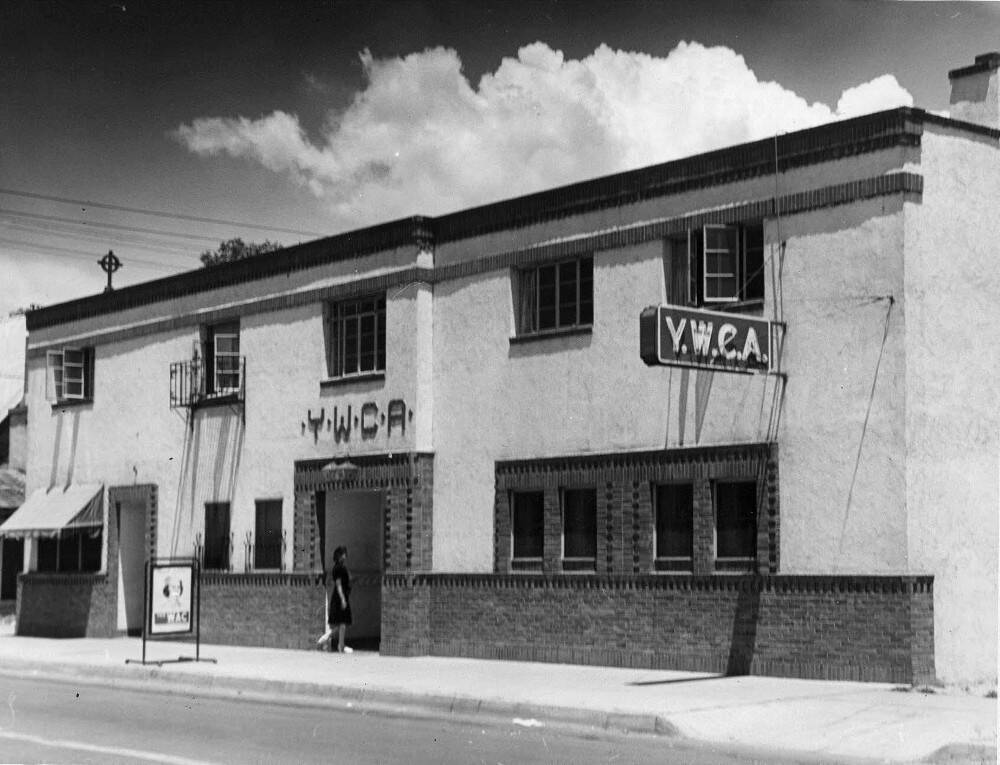

Day 6

Our Second Home: Another move! In 1985, Housing New Mexico settled into its new home at 344 Fourth Street SW in Albuquerque. Originally built for the city's YWCA in 1940-1941, this historic gem was designed by Gordon Ferguson Architects and constructed by JE Morgan & Sons for just $4,500.

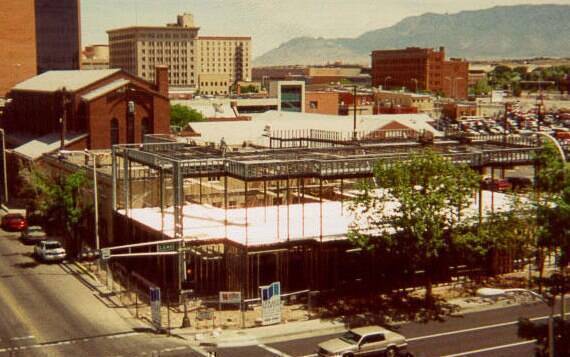

Day 7

When Housing New Mexico bought the YWCA building on Fourth Street in 1985, it was renovated to accommodate a staff of 26. Part of the remodel involved removing a gas station located in the front lot, which belonged to PNM, whose offices were directly to the west. After the transfer of state housing programs to Housing New Mexico in 1997, the agency experienced rapid growth. In 2000, the building underwent a major renovation that added more than 13,000 square feet of space. By the time Housing New Mexico moved out of the Fourth Street building in September 2024, the staff had grown to about 120.

Day 9

Housing New Mexico issued over $200 million in bonds by refunding previously issued bonds. Here's what that meant for New Mexicans: 📆 It all started with the 1992 A and B bond issues, which funded $42 million in home loans, helping more New Mexicans into homes. 🏠 387 homeowners across 20 counties received rebate checks between $1,900 and $9,000—totaling $2.16 million! 💰 Housing New Mexico also added $12 million to its General Fund, helping launch several new housing programs.

Day 10

In 1994, Housing New Mexico established what was then known as the Loan Administration and Servicing Department—marking a significant milestone in our commitment to long-term homeownership success. Today, this important component is proudly known as the Servicing Department, and it continues to play a critical role in the lifecycle of every loan and grant we manage, from acquisition/funding through final disposition.

Day 11

In 1995, Housing New Mexico was the sole participant in the U.S. Department of Housing and Urban Development’s 542c program within a five-state region. This milestone marked the start of our mission to produce and preserve affordable apartments. 🔑

Day 12

By July 1, 1997—less than four months after Gov. Gary Johnson designated Housing New Mexico as the state’s housing finance authority— new programs were incorporated while existing operations continued seamlessly. Housing New Mexico helped relocate the 20 employees who had been working at the state’s housing department to other state jobs. Three of those state employees were hired to work for Housing New Mexico, and two new employees joined the team, for a total of five employees. Housing New Mexico empowered nonprofits, developers and housing professionals to manage daily operations, and formed task forces to improve service delivery.

Day 13

In 1997, Gov. Gary Johnson transferred all the state’s housing programs to Housing New Mexico, including the Low-Income Housing Tax Credit Program (LIHTC) and federal HOME funding. Having the LIHTC program and HOME funding allowed Housing New Mexico to finance millions of dollars in housing construction and rehabilitation projects every year. Housing New Mexico also became responsible for homelessness prevention and assistance programs, weatherization, special-needs housing and rental assistance programs.

Day 14

When Gov. Gary Johnson signed an executive order making Housing New Mexico the state’s housing finance authority in 1997, original program funding was as follows: Emergency Shelter Grant: $900,000, Continuum of Care: $1.3 million, Rental Assistance Program: $220,000, Weatherization Assistance Program: $2 million, Housing for Persons with AIDS/HIV: $1.1 million and Low-Income Housing Tax Credits: $30 million

Day 15

In 2001, Housing New Mexico’s Asset Management Department was established to ensure the long-term success of affordable housing across the state. The department continues to monitor Housing New Mexico’s portfolio of properties for compliance with federal housing regulations. - Portfolio includes 20,000+ units at 300+ communities. - Team conducts compliance audits & inspections. - Contract with U.S. Department of Housing and Urban Development includes 84 Section 8 properties. Protecting homes. Supporting families.

Day 16

In 2001, Housing New Mexico completed its first-ever Federal Housing Administration (FHA) Risk Share Loan on Tribal land — a major milestone in Tribal housing! Tsigo Bugeh Village at Ohkay Owingeh (formerly San Juan Pueblo) provided 31 new affordable apartments for Tribal members, thanks to four subsidies and strong partnerships. Funding highlights included: • $310K from the HOME Investment Partnership Program • $307K in Low-Income Housing Tax Credits • $300K from a Rural Housing & Economic Development Grant • A $180K loan funded by Housing New Mexico and insured by FHA under the 542(c) program — marking the first time this program was used on Native American trust lands Additional funds came from the Federal Home Loan Bank and Tribal resources through the Native American Housing and Self Determination Act. This community marked a significant achievement in advancing affordable housing on Tribal land in New Mexico.

Day 17

The Affordable Housing Act, championed by Rep. Ben Luján, was created in 2004. Since then, local governments in New Mexico have donated $117.8 MILLION in land and resources under the Act. Under the Act, local governments can donate land, buildings, and funds to help build and preserve affordable homes. 🏘️ With support from Housing New Mexico, there are currently 39 local governments that have stepped up—creating housing plans, passing ordinances, and putting real resources behind real solutions. This is what investing in the community looks like. 💪

Day 18

The New Mexico Affordable Housing Tax Credit Program was created by the approval of the Affordable Housing Tax Credit Act by the state legislature in March of 2005 and signed into law by Gov. Bill Richardson in April of 2005. Rep. Daniel P. Silva and Sen. John Arthur Smith sponsored the legislation. State tax credits are available to individuals and businesses that make donations to the program, and the tax credit is equal to 50% of the donation’s value.

Day 19

Championed by Sen. Nancy Rodriguez, the New Mexico Housing Trust Fund Act was signed into law during the 2005 legislative session. With a $10 million appropriation, the Act created a mechanism for the state to provide funding for affordable housing construction.

Day 20

Housing New Mexico created the New Mexico Affordable Housing Charitable Trust in 2007. The following year, the Internal Revenue Service granted approval of the Trust’s tax-exempt status under section 501(c)(3) of the Internal Revenue Code, allowing donations to be made to the New Mexico Affordable Housing Tax Credit Program. Through the program, state tax credits are available to individuals and businesses that provide donations to help build affordable housing. Donations may be made directly to an affordable housing development that has been approved by Housing New Mexico or to the New Mexico Affordable Housing Charitable Trust. The credit is equal to up to 50 percent of the value of the donation, which may include land, buildings, money or services. Dennis and Iesha Larrañaga became homeowners through Santa Fe Habitat for Humanity, supported by the New Mexico Affordable Housing Tax Credit Program. (Photo courtesy Santa Fe Habitat for Humanity)

Day 21

El Cerrito Apartment Homes in Taos was completed in 2007 to serve people experiencing homelessness and families displaced by domestic violence. Funded by Housing New Mexico, the developers took the rare step of presenting their design to the public—and adjusted plans based on community feedback before building. 💙 Housing New Mexico believes that everyone deserves a safe place to call home—and we're working every day to make that a reality. 🏡

Day 22

While the nation struggled, Housing New Mexico stepped up. From 2008–2011, we: ✅ Maintained all programs and services ✅ Allocated $95M+ in federal stimulus ✅ Built tools for fast, effective funding Results: 🏠 3,691 homes weatherized 🚪 $6.8M in rapid rehousing 🏗️ Nearly 1,000 affordable homes built or rehabbed Because even in the hardest times, we never stopped housing New Mexico.

Day 23

In 2015, Housing New Mexico—then led by former executive director Jay Czar—celebrated its 40th anniversary, a milestone that reflected four decades of commitment to affordable housing in our state. Since 1975, we’ve helped thousands of New Mexicans find stability, opportunity, and a place to call home. The 40th anniversary was more than just a celebration—it was a reaffirmation of our mission and the lives touched along the way.

Day 24

Housing New Mexico launched Phase I of its Servicing Expansion Project in June 2016 in partnership with the Idaho Housing and Finance Association (IHFA). During this phase, Housing New Mexico purchased the Mortgage Servicing Rights (MSRs) for its first-time homebuyer loans, while IHFA pooled, securitized, and sub-serviced the loans under Housing New Mexico’s seller/servicer number via a hybrid sub-servicing agreement. This strategic approach provided Housing New Mexico with financial control over the MSRs and established a new, sustainable revenue stream.

Day 25

In 2017, Housing New Mexico celebrated a lending record—helping more than 2,500 families across the state achieve homeownership. With $370.5 million in Housing New Mexico loans and $14.5 million in down payment assistance (a 21% increase from the previous year), we made homeownership possible for thousands of New Mexicans

Day 26

In 2018, Housing New Mexico launched HomeNow—another innovative product designed to help more New Mexicans achieve the dream of homeownership. HomeNow is a second mortgage loan that provides down payment and closing cost assistance to first-time homebuyers with lower household incomes. The loan has a 0% interest rate and may be forgiven after 10 years if specificconditions are met. Since its creation in 1975, Housing New Mexico has continued to work toward its vision: that all New Mexicans will have quality affordable housing opportunities through programs like HomeNow.

Day 27

In 2019, Isidoro Hernandez was named Housing New Mexico’s sixth executive director, bringing with him nearly three decades of experience and leadership within the organization. Isidoro began his journey with Housing New Mexico in 1992 as a management trainee and worked his way through nearly every department—serving as director of single-family programs, director of community development, and deputy director of programs. His deep understanding of the agency’s mission and operations made him a natural choice to lead.

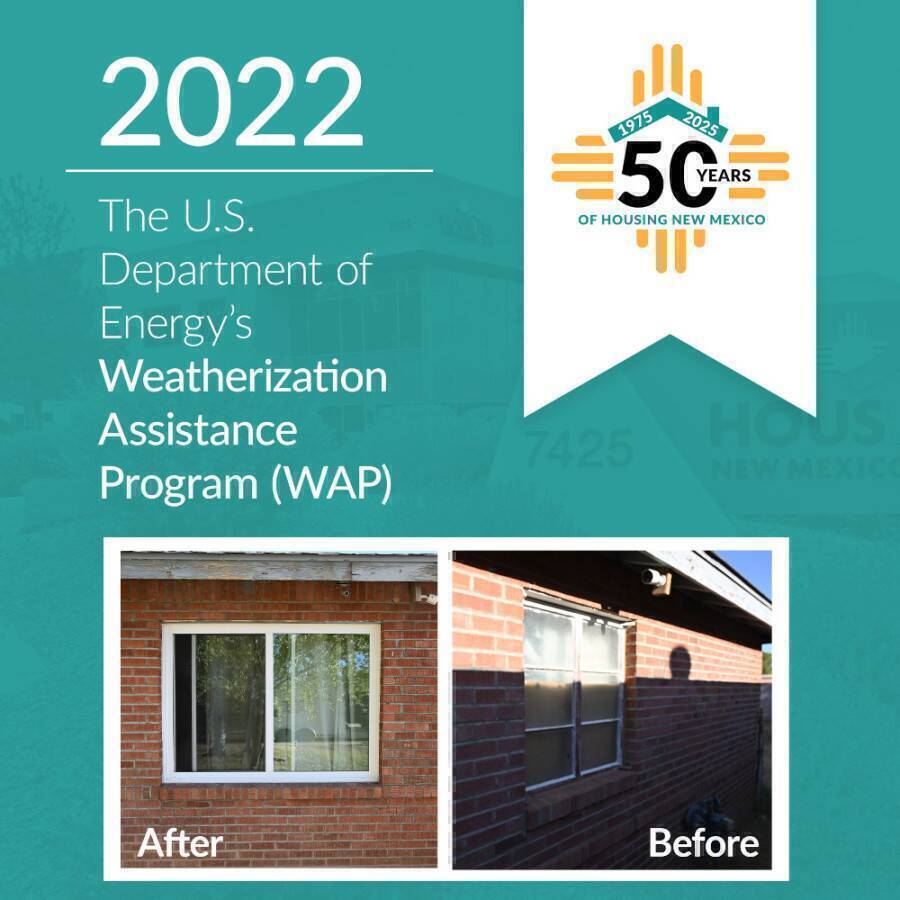

Day 29

The U.S. Department of Energy’s Weatherization Assistance Program (WAP), delivered locally through programs like NM Energy$mart, helps families make their homes more energy-efficient, safe, and comfortable. Just ask Joani Amos, who shared: “Not a day goes by that I am not thankful for this wonderful blessing! Winter and summer I no longer worry about being comfortable in this old house or worry about utility bills I can’t pay. Thank you seems barely enough to show my gratitude and joy from the blessings you all have brought to me.”

Day 30

The Landlord Collaboration Program helps young adults at risk of homelessness find safe, stable housing by connecting them with supportive landlords. Through a partnership between CYFD, Housing New Mexico, and youth service providers, the program encourages successful tenancies and brighter futures. One young person shared: “I felt like being a young person trying to rent was a burden. Everywhere I would go, it was like they didn’t want me there. In my old place they told me I should feel lucky to have this place, even though I didn’t like it. Since the program, they have been able to connect me with a landlord in the program who really cares about my comfort. I love my new place, and I feel like I can talk to my landlord about stuff.”

Day 31

Since its inception in 1975, Housing New Mexico has helped the dream of homeownership become a reality for many New Mexicans. In 2023, Tai Wilson realized her homeownership dream thanks to Housing New Mexico and participating lender, Nikki Sandoval-Belt with Cornerstone Home Lending in Farmington. “You have no idea how thankful I am for the MFA program. I’m super thankful and I cannot believe I’m here in my own home with my kids. I’m super excited to work for something that’s going to be mine in the long run and, hopefully, my kids’ when they grow up. Thank you very much. You guys rock.”

Day 32

Each year, Albuquerque Business First highlights businesses through its Best Places to Work Awards. Among these prestigious organizations in 2023 was Housing New Mexico, acknowledged in the large company category. Housing New Mexico claimed its spot as 4th in the large company category, advancing a spot from its 2022 ranking.

Day 33

Housing New Mexico is proud to partner with San Felipe Pueblo Housing Authority to rehabilitate homes for many homeowners across New Mexico. Together, we've made a lasting impact—helping community members like Willie Garcia, who generously shared his story with us in 2023. Willie began building his home over 20 years ago for his young daughter. Now a grandfather, he dreamed of completing the home for his growing family—a place where they could feel safe, loved, and rooted. When he couldn’t finish it alone, the Home Rehabilitation Program—made possible through our partnership—stepped in to help. His story is a powerful reminder of how collaboration can turn dreams into reality for generations.

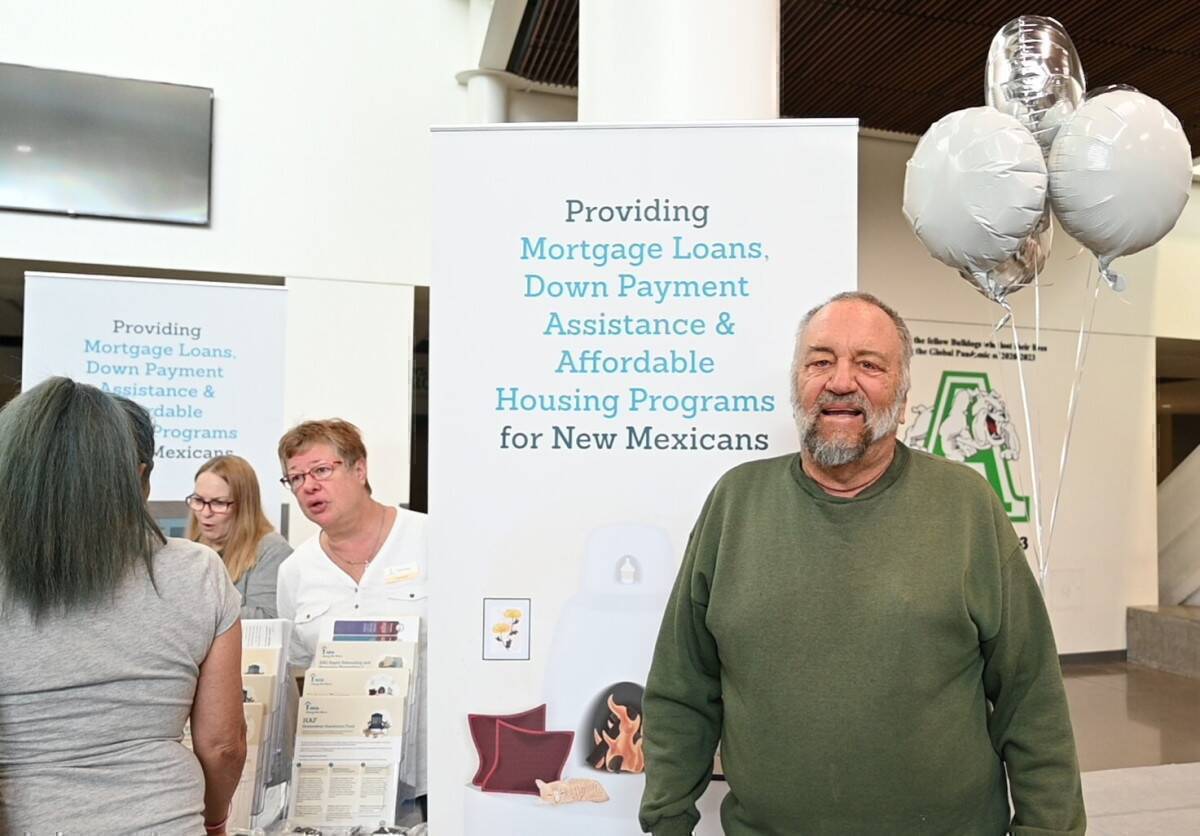

Day 34

In 2023, Robert Leech stopped by our table at the PNM Good Neighbor Fund Event just to say thank you. He was one of the many New Mexicans who benefitted from the New Mexico Homeowner Assistance Fund (HAF) program, available from 2021 to 2024. Funded by the U.S. Department of the Treasury and offered in partnership with the New Mexico Department of Finance and Administration, HAF helped homeowners like Robert stay in their homes by covering past-due mortgage payments, property taxes, utility bills, and more during times of financial hardship. We’re proud to have made a difference for thousands of New Mexicans like Robert.

Day 35

In December 2023, the Housing New Mexico Board of Directors awarded $500,000 to the New Mexico Ramp Project through the Housing Innovation Program. The New Mexico Ramp Project is a nonprofit organization that brings together volunteers to build wheelchair ramps for individuals who need them—empowering people with greater independence and accessibility in their homes. This funding helps scale their important work and reflects our shared commitment to creating inclusive, supportive communities across New Mexico.

Day 37

During a July 2024 news conference, CEO/executive director Isidoro Hernandez announced New Mexico Mortgage Finance Authority rebranded to Housing New Mexico, and a new logo was unveiled. “When New Mexico Mortgage Finance Authority was created by the state legislature in 1975, its focus was mortgage assistance for low-income households,” said Hernandez. “We have grown into so much more, with regard to the programs and services we offer, and ‘Housing New Mexico’ is more reflective of our diverse suite of services and makes a strong statement.”

Day 38

The year 2024 was a big year of change for Housing New Mexico. Our staff grew to over 120, and in September, we moved into a more spacious and accessible building at 7425 Jefferson Street NE. The Jefferson building provides more office space for employees, more parking space for guests and partners, and has a much larger board room to accommodate meeting attendees.

Day 39

On October 30, 2024, Governor Michelle Lujan Grisham officially proclaimed the day as Weatherization Day in New Mexico, recognizing the critical role weatherization plays in improving the lives of low-income households across the state. The NM Energy$mart Weatherization Program, administered by Housing New Mexico | MFA since 1997, has helped thousands of families reduce energy costs, increase home safety, and improve energy efficiency—thanks to support from the U.S. Department of Energy, New Mexico Gas Company, PNM, El Paso Electric, and more. This proclamation honored the dedicated professionals, nonprofits, and partners working together to make homes healthier, safer, and more affordable for New Mexicans.

Day 40

In May 2024, several Housing New Mexico employees rolled up their sleeves and volunteered with Greater Albuquerque Habitat for Humanity to help build affordable homes in southeast Albuquerque. We're proud to support safe, stable housing—and even prouder of our team for putting our mission into action. 💙 50 years strong and we’re just getting started.

Day 41

In April 2024, we celebrated the grand opening of Ceja Vista Senior Apartments, a 156-unit multifamily community. The two three-story buildings offer quality, affordable housing made possible through key partnerships with Housing New Mexico. Ceja Vista was made possible through various Housing New Mexico-funding sources, including a National Housing Trust Fund Loan in the amount of $1.5 million and approximately $13.6 million in 4% Low Income Housing Tax Credits, which are expected to produce over $11 million in equity for the project over 10 years. Ceja Vista stands as a meaningful milestone in senior living and community development. We’re proud to have been part of this impactful project!

Day 42

Laguna Housing Development and Management Enterprise proudly celebrated the grand opening of East Paraje Apartments in July 2024. A thoughtfully designed community featuring 20 affordable homes, with 25% targeted at families with children. The development was supported by Housing New Mexico, which awarded approximately $9.3 million in federal Low-Income Housing Tax Credits over a 10-year period. These credits are expected to generate about $7.8 million in equity, helping make this vital housing opportunity a reality. This milestone reflects our commitment to building stronger communities across New Mexico.

Day 43

Housing New Mexico joined Sol Housing and others to celebrate the Farolito Senior Community groundbreaking in Albuquerque in September 2024. The new, affordable community will serve seniors aged 55 and over. Housing New Mexico awarded the community approximately $16.2 million in federal Low-Income Housing Tax Credits over a 10-year period, which are expected to produce approximately $14.2 million in cash equity. Housing New Mexico contributed about 57.8% of the financing for the development. This development reflects how partnerships lead to stronger communities throughout the state.

Day 44

Barbara Bloom’s home benefitted from Housing New Mexico’s NM Energy$mart Weatherization Program and was celebrated on Weatherization Day October 30, 2024. Central New Mexico Housing Corporation – one of Housing New Mexico’s many partners – performed energy-efficient upgrades to the home in Albuquerque. The NM Energy$mart Weatherization Program’s primary goal is to lower energy costs for low-income households by reducing their energy consumption, while improving their health and safety. Housing New Mexico administers the program through community-based nonprofit organizations offering statewide services.

Day 45

In 2024, the New Mexico Mortgage Finance Authority Board of Directors approved a $3 million New Mexico Housing Trust Fund revolving construction line of credit to Artisan’s Guild Contracting, LLC for the development of El Toro Community in Roswell. This investment supported much-needed housing in the region and highlighted our ongoing commitment to building stronger, more vibrant communities across the state.

Day 46

We were honored to have our Housing New Mexico Board Member and Lieutenant Governor Howie Morales join us for our celebratory Open House this past December as we marked a major milestone—the opening of our new office building! Lt. Gov. Morales’ leadership has been instrumental in the success of housing in New Mexico, and we’re grateful for his continued commitment to our mission. Here’s to new spaces, stronger communities, and 50 years of impact! 💙

Day 47

We were honored to have State Treasurer Laura M. Montoya, a dedicated member of the Housing New Mexico Board, join us at our Open House last December as we celebrated the opening of our new office! Her leadership and advocacy continue to shape the future of housing across New Mexico, and we’re thankful for her commitment to our mission. Celebrating five decades of progress and the leaders who make it all possible. 🏠

Day 48

Community Action Agency of Southern New Mexico was the first organization to apply under Housing New Mexico’s HOME-American Rescue Plan (HOME-ARP) open Notice of Funding Availability (NOFA) — and the first to be approved! ✅ In December 2024, Community Action Agency was awarded $100,000 to provide Rapid Rehousing and Homelessness Prevention services in Luna and Grant counties, expanding the agency’s work beyond Las Cruces to support even more New Mexicans. 🏠

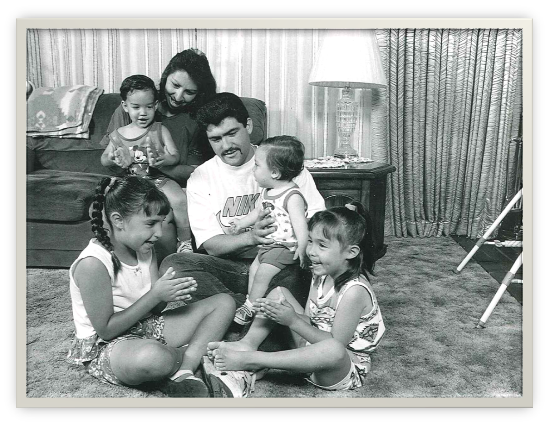

Day 49

For 50 years, Housing New Mexico has helped New Mexicans find safe, affordable housing, and in many cases, realize the dream of homeownership. Ramirez family members in Belen started the new year as homeowners – a journey made possible by Housing New Mexico and several of its partners.

Day 50

As Housing New Mexico embarked on 50 years of existence, a 50th anniversary logo contest among employees was held to best capture this important milestone. Patrice Antonio’s design concept was the inspiration for Housing New Mexico’s 50th anniversary logo. Congratulations, Patrice, and thank you for helping us mark this historic milestone!