Lenders and REALTORS

Property Managers

Your Credit Score

If you’ve ever had credit problems, you’re not alone. At some point in their lives, many adults find themselves facing issues with past-due bills, collections and other negative credit issues.

Falling behind on payments could be the result of job loss, divorce, illness or simply irresponsible behavior. But no matter the reason for our past failures, we all have an opportunity for a fresh start. The credit rating you have today isn’t permanent. With some hard work and diligence, you can make drastic improvements over time.

Steps to Improve Your Credit Score

- Reestablish your credit history if you've had problems. If you have missed payments, get current and stay current. The longer and more consistently you pay your bills on time, the higher your score will eventually be.

- Manage credit cards responsibly. Make all payments on time and strive to only use 30 percent or less of your available credit on each account. High outstanding debt can negatively affect your score.

- Resolve to pay down your outstanding debt. Developing a monthly budget and being mindful of spending will help you find “extra” money each month to put towards paying off debt.

- Don’t close unused credit cards as a short-term strategy to raise your score. One factor in a credit score is the overall age of your credit file. If you close a card that has a long-term history, you could significantly reduce the overall age of your credit file, which in turn could lower your score.

- Be aware that closing an account doesn’t cause it to drop from your credit report. A newly closed account will still show up on your credit report, and the payment history continues to impact your score.

- If you have been managing credit for only a short time, don’t open several new accounts too quickly. New accounts will lower your average account age. This will adversely affect your score; particularly if your file contains a limited number of tradelines. Additionally, rapid account buildup can be a red flag to lenders because you’ll appear to be a high-risk borrower.

- Apply for new credit accounts only as needed. Don’t open accounts just to have a better credit mix.

- Opening new accounts responsibly and paying them off on time will raise your score in the long term.

- Don’t open new credit card accounts that you don’t need just to increase your available credit. This approach could backfire and lower your score.

- If you are having trouble making ends meet, contact your creditors, or see a legitimate nonprofit credit counselor. This will not improve your score immediately, but if you can begin to manage your credit and pay on time, your score will get better over time. A list of MFA’s housing counseling partners may be viewed here.

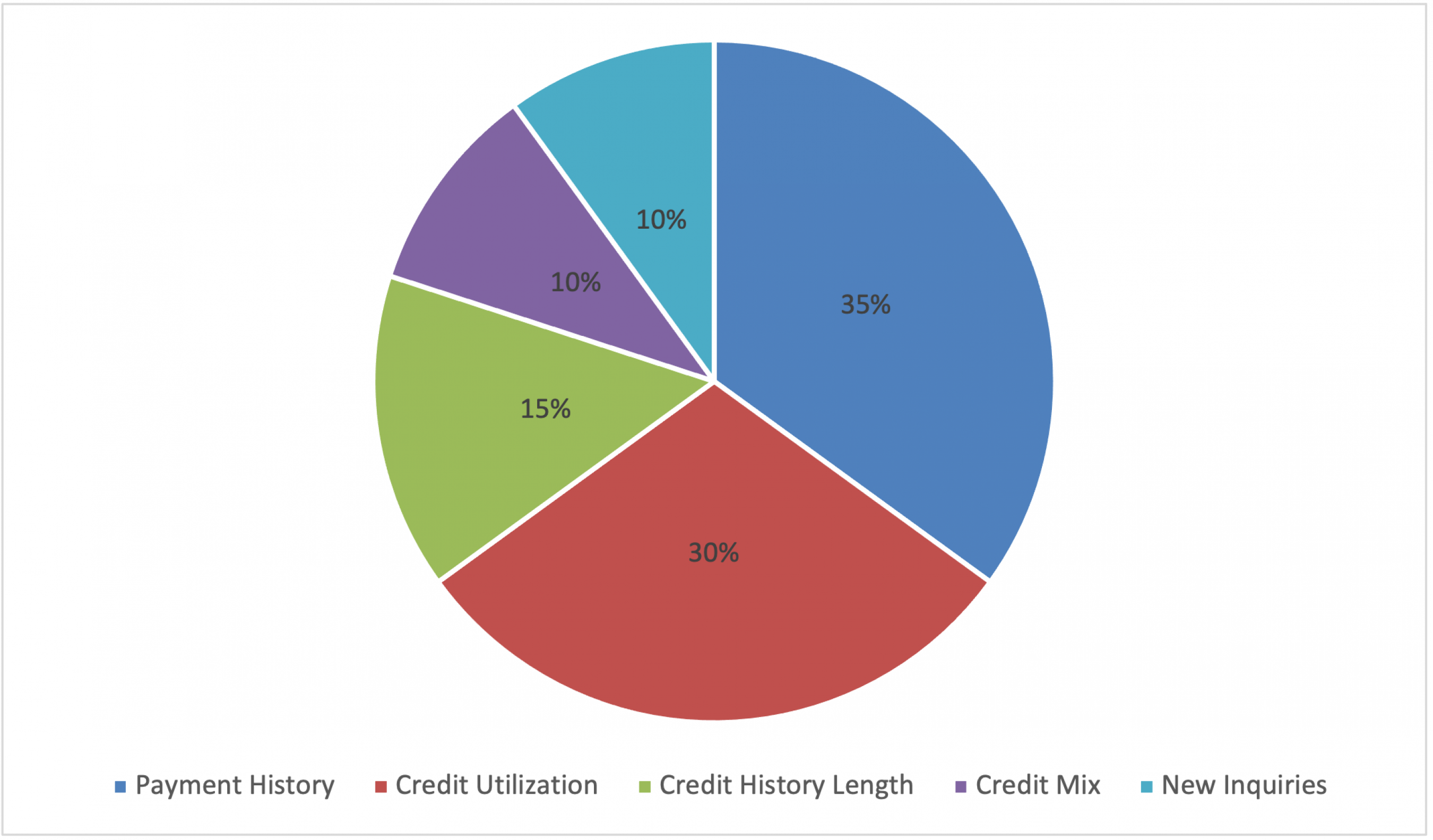

How Credit Scores are Calculated

Ever wonder what factors make up your credit score? Here they are from largest to smallest:

- Payment history accounts for 35 percent of your score. Therefore, it is critical that you make monthly payments on time. Doing so gives the lender assurance that you’re likely to pay them on time as well, should they extend you credit.

- Amounts owed and credit utilization account for 30 percent of your score. The percentage of each account used as compared to the available credit limit is very important. Try not to utilize more than 30 percent of each available revolving account (i.e., credit cards and personal lines of credit). A consumer who routinely “maxes out” their credit cards will have a lower score.

- Credit history length accounts for 15 percent of your score. The age of all credit accounts – including the oldest and newest – are averaged to come up with the length of history. When an older account is closed or a new account is opened, the average length of your history is negatively impacted and will lower your score.

- Credit mix accounts for 10 percent of your score. Scoring models give higher marks to consumers with a “good” mix of credit. For example, having one or two credit cards, an auto loan and a personal loan will result in a higher score than having nothing but credit card accounts.

- Lender inquiries account for the final 10 percent of your score. Consumers who apply for several new accounts – even if they don’t actually open new accounts – will score lower. The scoring model works on the assumption that each of those inquiries likely resulted in a new debt obligation, which makes you appear riskier. Therefore, your score will be lowered.

If you would like some help improving your credit score, go here to see a list of housing counseling agencies.